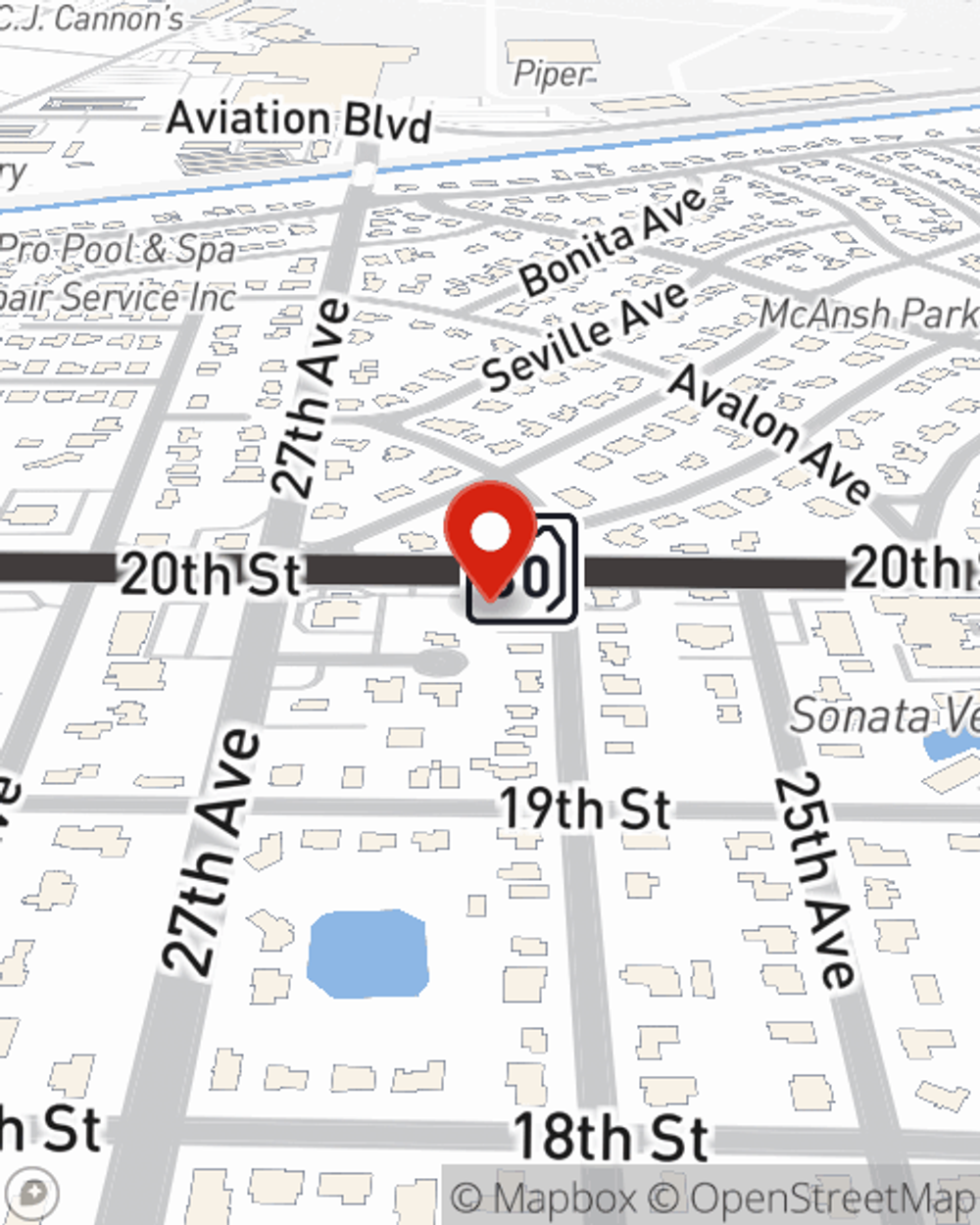

Life Insurance in and around Vero Beach

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Treasure Coast

- Indian River County

- Vero Beach

- Winter Beach

- Wabasso

- Fort Pierce

- Indian River Shores

- Vero Beach South

- West Vero Corridor

- Florida Ridge

- Gifford

- Sebastian

Check Out Life Insurance Options With State Farm

Purchasing life insurance coverage can be a lot to think about with a variety of options out there, but with State Farm, you can be sure to receive compassionate reliable service. State Farm understands that your purpose is to protect your loved ones.

Protection for those you care about

Now is the right time to think about life insurance

Wondering If You're Too Young For Life Insurance?

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Jordan Hedges is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

Contact State Farm Agent Jordan Hedges today to see how the leading provider of life insurance can care for those you love most here in Vero Beach, FL.

Have More Questions About Life Insurance?

Call Jordan at (772) 567-8958 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Jordan Hedges

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.