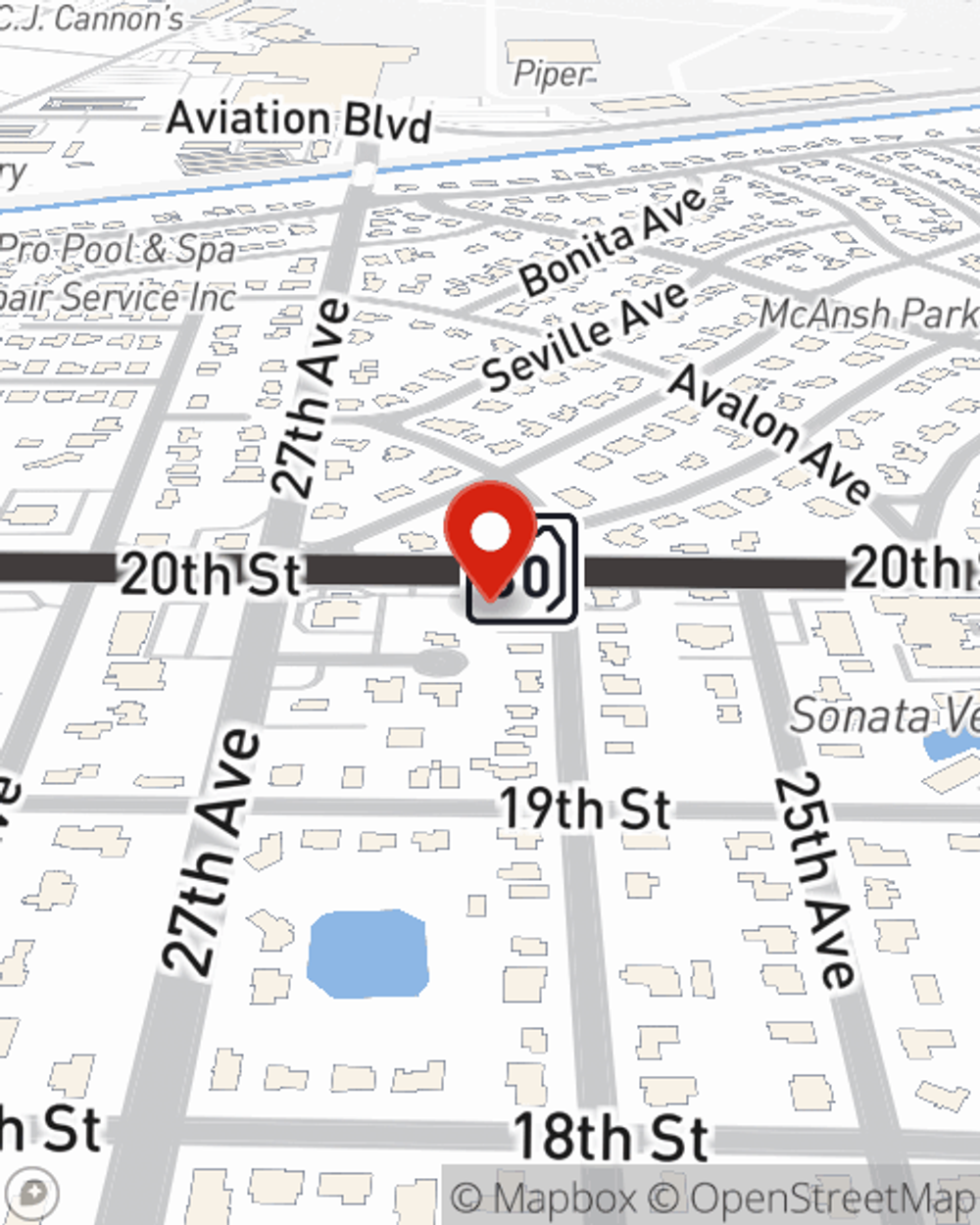

Condo Insurance in and around Vero Beach

Welcome, condo unitowners of Vero Beach

Cover your home, wisely

- Treasure Coast

- Indian River County

- Vero Beach

- Winter Beach

- Wabasso

- Fort Pierce

- Indian River Shores

- Vero Beach South

- West Vero Corridor

- Florida Ridge

- Gifford

- Sebastian

Home Is Where Your Condo Is

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from vandalism, weight of ice, or freezing pipes.

Welcome, condo unitowners of Vero Beach

Cover your home, wisely

Put Those Worries To Rest

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Jordan Hedges is ready to help you prepare for potential mishaps with dependable coverage for all your condo insurance needs. Such thoughtful service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Jordan Hedges can help you submit your claim. Keep your condo sweet condo with State Farm!

Fantastic coverage like this is why Vero Beach condo unitowners choose State Farm insurance. State Farm Agent Jordan Hedges can help offer options for the level of coverage you have in mind. If troubles like wind and hail damage, drain backups or identity theft find you, Agent Jordan Hedges can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Jordan at (772) 567-8958 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Jordan Hedges

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.